If you’re ever caught between a rock and a hard place due to mounting debt, filing bankruptcy may the smartest decision you can make.

Fare Better in the Long Run

Study after study concludes that individuals who declare bankruptcy in the face of ballooning debt generally fare better in the long run, compared to those who stick it out and try to pay off balances.

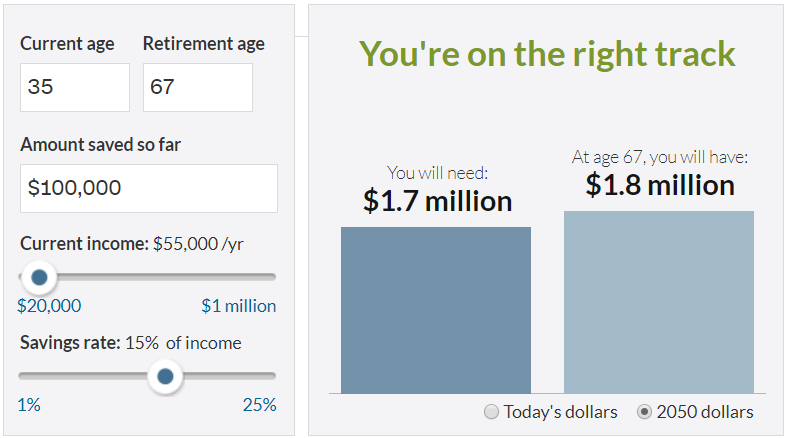

This point of view focuses on retirement income that could be secured from savings/disposable income – that would only be available through bankruptcy.

Case in Point:

Most times, paying money toward a large debt every month doesn’t reduce the final balance. It’s simply a drop in the bucket.

Oftentimes, borrowers are simply paying the interest and not the principal sum owed.

If, however, you file bankruptcy, the money you would spend paying years of interest could be applied to a retirement savings account.

With the value of compound interest, this alternate use of funds benefits filers more.

In other words, filing bankruptcy today helps you maintain self-sufficiency in years to come.

Use a free retirement calculator to estimate how saving a few hundred dollars each month via bankruptcy stacks up to paying down debt. ↓

Filing Bankruptcy Makes Good Financial Sense

Many well-meaning Americans are often conflicted by a moral obligation to pay vs. dealing with financial burdens.

In the face of ballooning debt with no end in sight, however, bankruptcy is generally justifiable.

Most filers don’t set out to declare bankruptcy. It’s usually situations beyond their control that set off a downward spiral, such as a job loss, illness, or divorce, for example.

Before you know it, a small debt inflates very quickly to thousands of dollars.

This makes it very difficult to catch up while still maintaining a basic livelihood.

In such extenuating circumstances, filing bankruptcy makes good financial sense.

Protect Your Assets

Another smart move to make is securing an experienced debt relief attorney. A good one, such as Campione Hackney, can help protect your assets during the process.

With a debt relief attorney in your corner, you stand a better chance of securing an automatic stay and keeping the most vital assets you depend on to take care of your family, including:

- Disability Income

- Salary and Wages

- Prepaid College Plans

- Pension and Profit Sharing Plans, IRAs

- Life Insurance Policies and Annuity Contracts

Desperate Times Call for Desperate Means

Our Lake County bankruptcy attorneys will tell you that bankruptcy is a decision that shouldn’t be taken lightly. When there is simply no other way to get out of debt, a bankruptcy attorney serves as a lifeboat to save you from the further downward spiral.

If your current livelihood is being threatened by a looming repossession, wage garnishment, or foreclosure, filing bankruptcy can help you regain control.

Consult with a Seasoned Bankruptcy Attorney

Call Campione Hackney in Lake County

(352) 343-4561